Stablecoin De-Pegging Protection Intent

Stablecoin De-Pegging Protection Intent

Intro

Welcome to the Stablecoin De-Pegging Protection Intent. As the crypto landscape grows more dynamic, protecting your investments against sudden stablecoin de-pegging has never been more crucial. This Intent is your frontline defense, offering real-time monitoring and automated interventions to shield your portfolio from volatility. Discover the value and peace of mind it brings to your crypto transactions.

Key Takeaways

– Automated Protection: Activates automatically to safeguard your assets during de-pegging incidents.

– Real-Time Monitoring: Ensures constant vigilance over your stablecoins, comparing them against their pegged values.

– User-Friendly Design: Simple for everyone, from crypto beginners to experienced traders, to set up and use.

The LUNA De-Pegging Event

A stark reminder of the volatile nature of cryptocurrencies came from the dramatic de-pegging of TerraUSD (UST) from its USD peg, which subsequently led to the catastrophic collapse of its sister token, LUNA. In May 2021, UST lost its peg due to massive sell-offs, triggering a death spiral for LUNA as the mechanism to maintain UST’s peg couldn’t cope with the market pressure. This event not only wiped out billions in market and individual values value but also shook investor confidence across the crypto sphere. It exemplifies the urgent necessity for tools like the Stablecoin De-Pegging Protection Intent, aimed at providing an automated safety net for investors against such unforeseen market turmoil.

How It Works

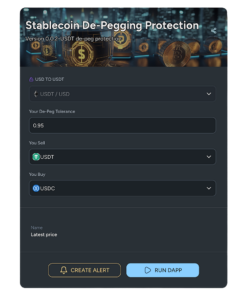

Monitoring Stablecoin Values: The Intent continuously monitors the exchange rates of stablecoins against their pegged values, typically the US dollar. This real-time tracking is crucial for detecting any deviations from the pegged value, which could indicate a de-pegging event.

Setting Trigger Thresholds: Set specific thresholds that define what you consider a de-pegging event. This customization allows you to tailor the Intent’s responsiveness to your risk tolerance and investment strategy.

Automated Response Mechanism: Once the value of a stablecoin falls below or rises above the set thresholds, indicating a de-pegging event, the Intent automatically triggers a protective action. This action is predetermined by you during the setup process.

Executing Protective Actions: The primary protective action involves swapping the affected stablecoins for other assets. You can choose to swap de-pegging stablecoins for more stable assets, other stablecoins, or even into cryptocurrencies that you believe will hold or increase in value during market turbulence.

Conclusion

The Stablecoin De-Pegging Protection Intent revolutionizes how we manage risk in the cryptocurrency space. By blending seamless automation with user-customizable triggers, it offers a robust solution for one of the digital currency world’s most volatile aspects. Step into a future where your investments are protected, and your mind is at ease. With this Intent, you’re not just investing in cryptocurrency; you’re investing in your peace of mind. Protect your Stablecoin today!